May 4 - 3:12 Minutes

Central Bank Digital Currencies: The Future Of Remittance (Chapter 1)

CBDC(Central bank digital currency) will play a significant role in shaping the future of the remittance industry. Experts believe it will revolutionise the way Money Services Firms conduct their business.

This research paper intends to provide a deep understanding of the impact of CBDCs on the remittance industry. Given the current circumstances, International Payments are ever more vital for economies, especially transactions underpinning tourism, e-commerce and remittances.

Technology is emerging continuously at a fast pace. In order to keep up with this evolution, many Central Banks started experimenting with Central Bank Digital Currencies, commonly known as CBDCs. Currently, more than eighty Central Banks globally are working on this emerging technology platform.

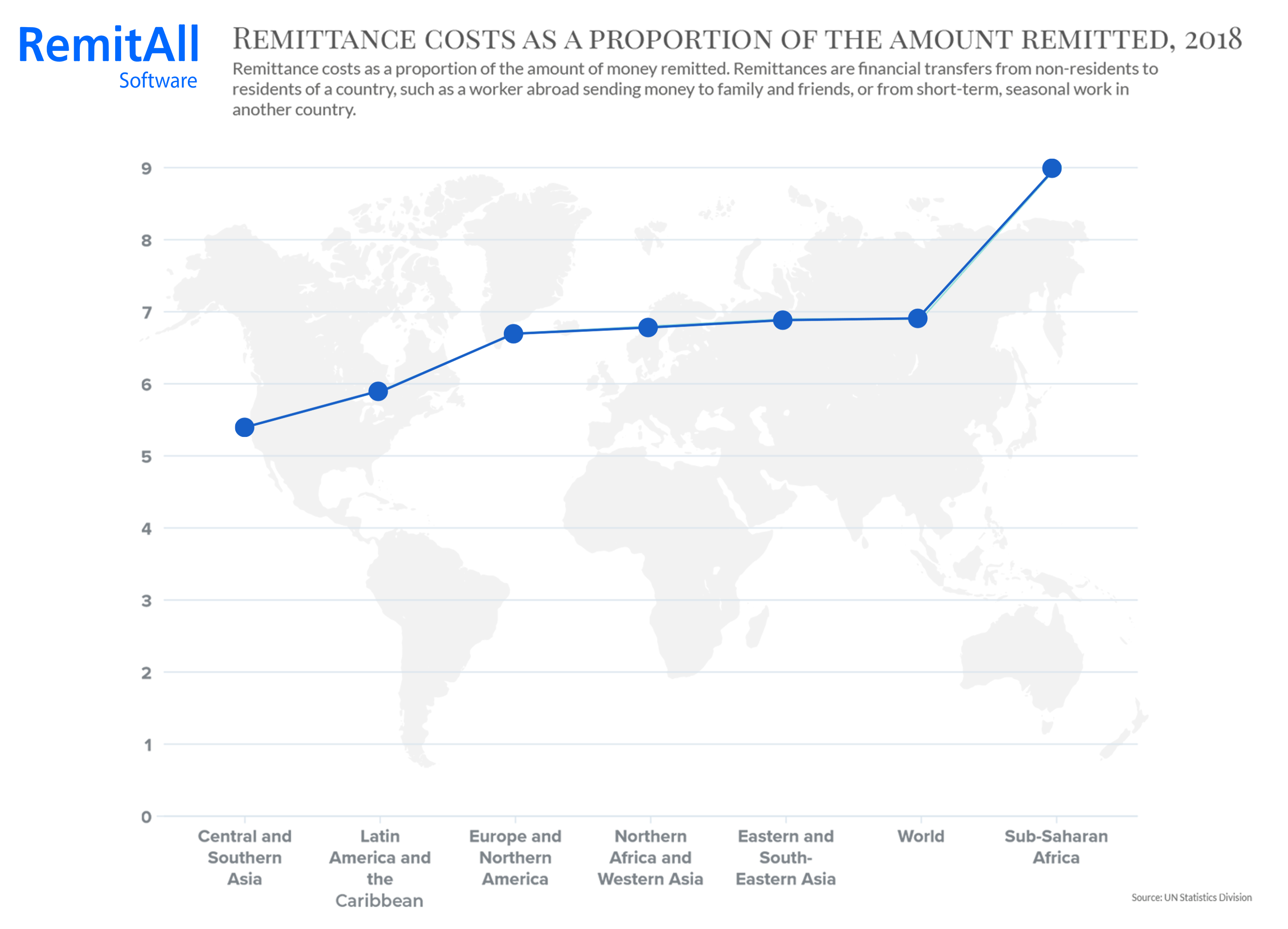

According to the IMF (International Monetary Fund), cross-border payments have limitations. It is primarily valid for lower-income countries and emerging markets, wherein average remittances cost stands at 7%. We must take note of the delay in delivering the money to its intended recipient in many cases.

Interestingly, correspondent banks—those providing access to cross-border payments—have shrunk in numbers by 22% since 2011. The steady drop in the number of correspondent banking relations in many countries worldwide remains a source of concern. In affected jurisdictions, there may be a consequence on the capability to transfer cross-border payments. This situation could force people into adopting unregulated and potentially risky ways of making international money transfers.

The Advance of Cryptocurrencies

Today Bitcoin is one of the most talked-about cryptocurrency. It is a widely discussed subject on social media. An intriguing part of cryptocurrency is the question of how they operate.

They function fundamentally by keeping all the records of the transactions in computers linked in peer-to-peer networks. The Bitcoin network, for example, collects all the transactions made during a set period (mostly every 10 minutes) into a list called a "block".

Furthermore, Bitcoin is a decentralised digital currency; It operates without a central bank or a single regulated administrator. It is possible to transfer a Bitcoin or part of it from user to user on the peer-to-peer network. Interestingly this is possible without the involvement of go-betweens. Network connections conduct transaction verification through cryptography and record it in a public distributed ledger called a blockchain.

Central bank digital currency will profoundly impact the remittance industry:

This paper will illustrate how digital currency can impact the remittance industry. Every year hundreds of billions of dollars transfer occurs internationally through agents and other payment systems.

Before falling to $508 Billion in 2020, Global Remittances touched record highs of $548 Billion in 2019.

The world bank predicts that the future of Remittance is the largest source of external financing in developing countries. United Nations has set aggressive 2030 sustainable development goals on remittance charges. It targets to reduce the transaction costs of migrant Remittance to less than 3 %. It is significantly lower than their current estimate average of 7.1%.

However, for remitting or receiving money through formal banking channels, a customer needs to have a bank account. Some studies suggest, globally, there are 1.7 Billion People outside the ambit of banking services. This situation demands an innovative resolution to the problem, and are Digital Currencies the Answer?

To answer this question, we will understand the scope of application of Digital Currencies. We will try to understand how an ordinary person can establish an interface with them?

One solution is the mobile phone; currently, there are more than 5.2 Billion mobile phone users worldwide. The Advent of mobile wallets powered by blockchain technology will change the way we make international payments. Mobile wallets are installed on mobile phones and offer various functionalities, including transferring money internationally. Blockchain technology enables this process. Blockchain is the most effective, honest and reliable alternative to expedite international payments.

The purpose of launching the CBDC's

In the current scenario of COVID-19, there is a need to change the payments system. A Bank of International Settlement (BIS) survey in 2021 found that 86% of central banks are researching the potential for CBDCs. Moreover, 60% are still experimenting with the technology, and 14% were deploying pilot projects.

IN simpler terms, A central bank digital currency (CBDC) would be a digital banknote. This currency will have two segments:

Retail CBDC

Wholesale CBDC

Retail CBDC

Retail payments consist of payments between individuals and businesses. Currently, cash is the most regularly used model of payment. However, cards and online transfers are catching up as a prominently used method of executing retail transactions. From 2010 to 2018, Electronic Payments rose sharply, by about 101 %, in the Eurozone.

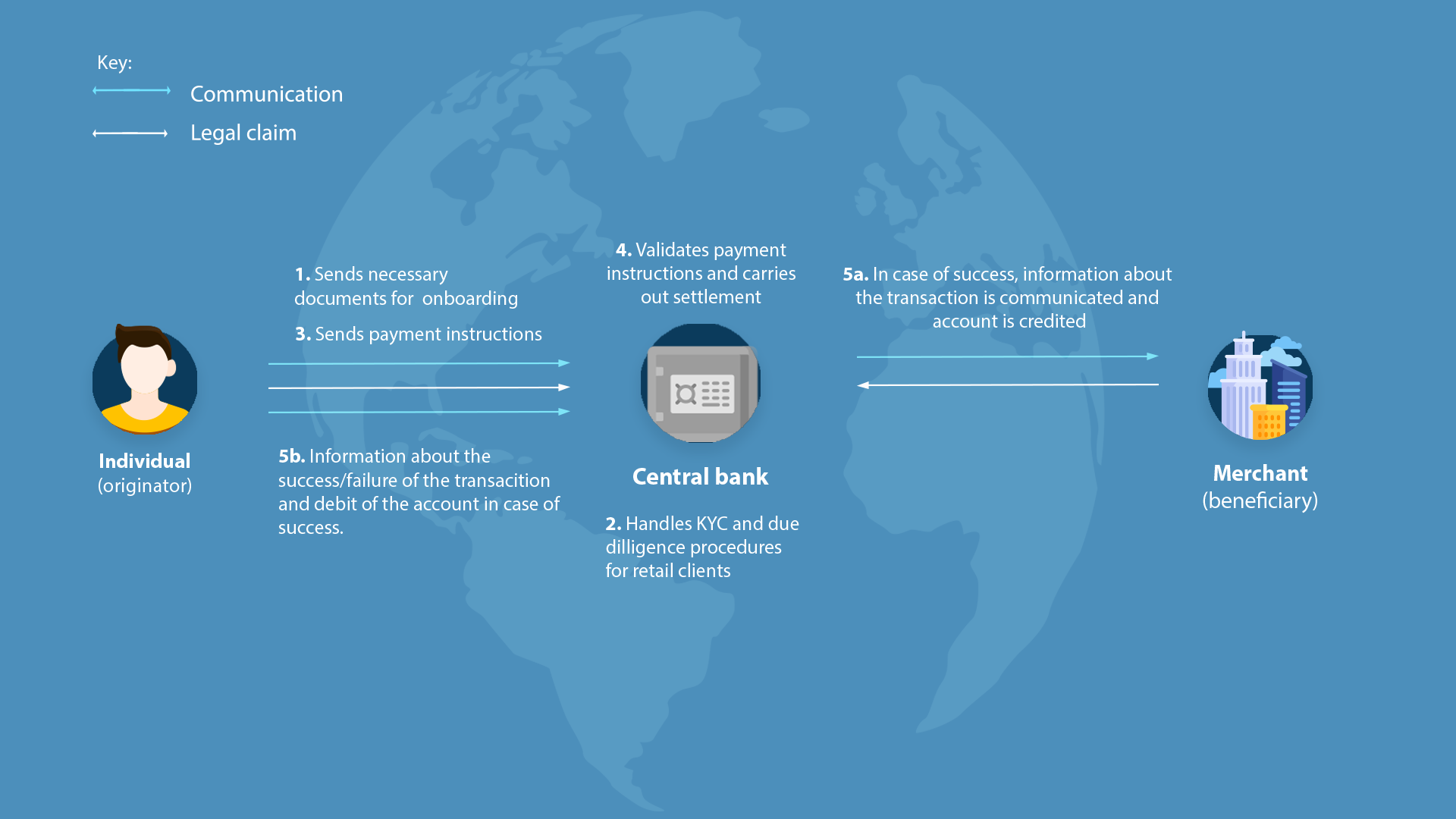

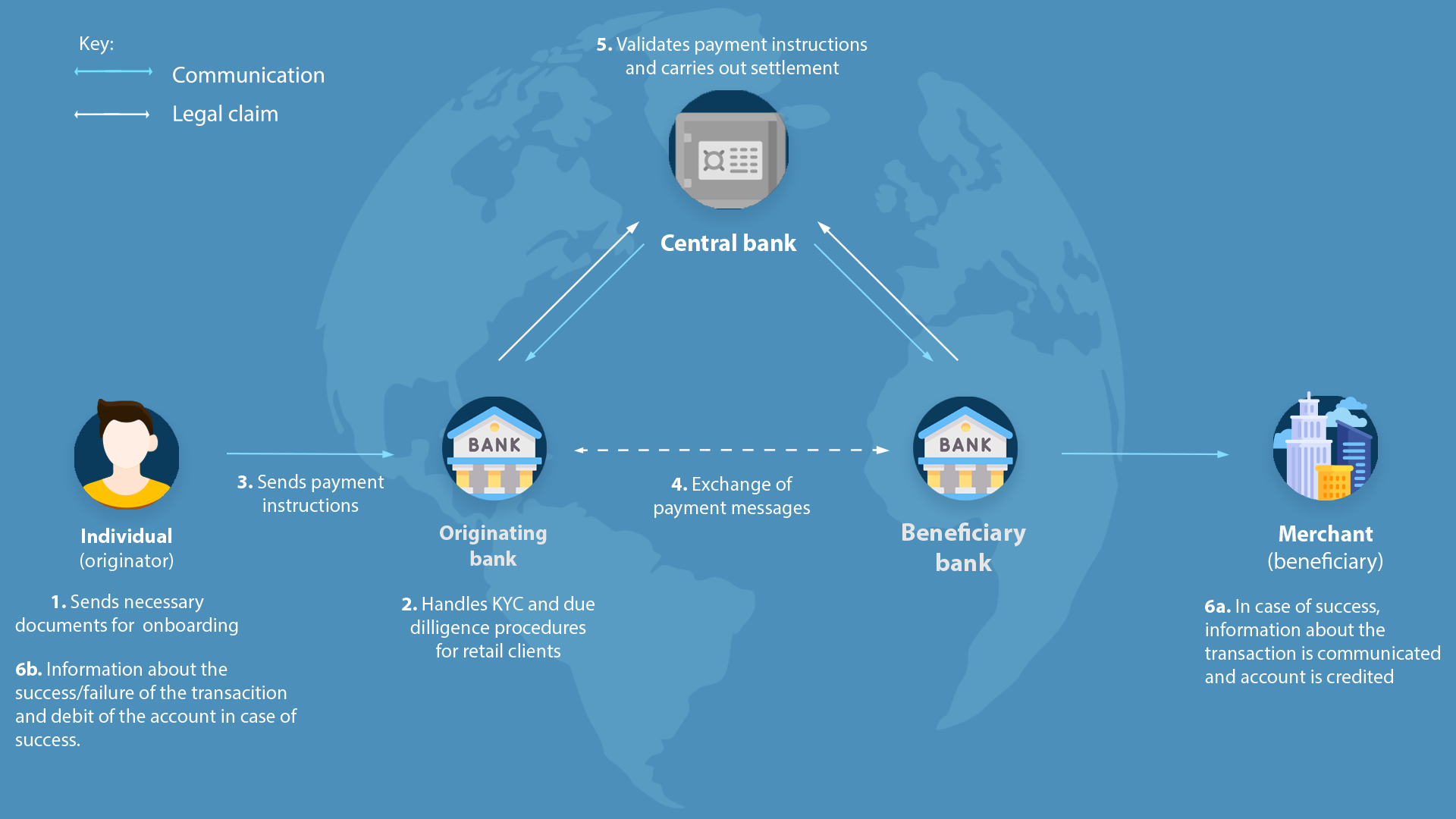

According to a report issued by Delloite, 'Are Central Bank Digital Currencies (CBDCs) the money of tomorrow?' The anticipated model for Retail CBDCs dealing in public is through two different forms, namely:

Deposit account in the central banks

Herein, experts envisage that individuals and businesses will have the option to open their accounts with the central bank. They will enjoy the same services they get from commercial banks.

Digitally issued tokens

Herein, Central Banks will issue CBDC tokens; moreover, the Commercial banks will further distribute these tokens.

It is not likely that the 'Deposit Account in the Central Banks' will find preference with the policymakers. Simply because

It will end up enhancing the workload of the Central Banks. They will have to take up many tasks that currently being undertaken by the commercials banks. KYC is a significant concern area that involves massive efforts to maintain regularly. Moreover, Central Banks will be better off with this management responsibility remaining with Commercial Banks.

This format will overhaul the way business is conducted today and blur the lines between a Commercial bank and Central Banks. With the anticipated growth in popularity

However, in Digitally Issued tokens, no notable structural changes are expected in the overall financial system.

Reading Time. 3:12 Minutes

Deepika

Deepika has completed her post-graduation from Guru Nanak Dev University, Amritsar, India. She is presently living in Kolkata, India. Her interest areas include academic research, writing articles and journalism.

Categories

Why do you send more and receive less during international transactions?

Mar 8-2 Minutes 45 Seconds

Cross Border Payments and Project ABER

Feb 3-2 Minutes 30 Seconds

English

English Português

Português